Each day, buyers and sellers go to battle.

If you get on the wrong side of the fight – you’re destined to lose money.

That’s why I make it a daily practice to study tick charts.

Not only does it show me where the buyers and sellers are…

But it also gives me a real-time picture of market health – an essential tool for day traders.

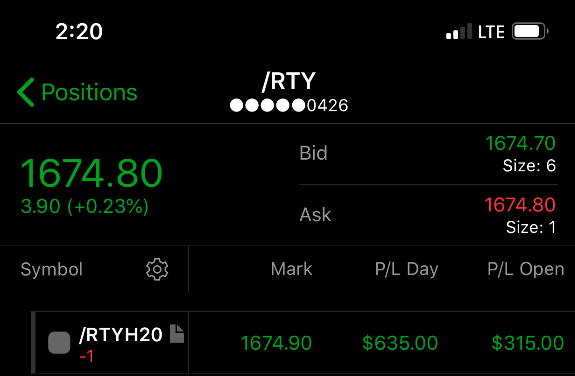

In fact, I applied it the other day for a quick scalp in the Russell.

I leveraged the Tick chart to time my entry and maximize my gains

However, to the naked eye, the tick chart can look like an abstract painting.

If you don’t know its nuances then you won’t be able to maximize its power.

That’s why I’ve outlined my best practices for implementing tick charts – which I’m going to share with you today.

Tick Chart Basics

Most people aren’t too familiar with this measure, so let me explain. The Tick chart tells me whether there is buying or selling at the New York Stock Exchange (NYSE).

There are approximately 2,800 stocks that trade on the NYSE. The Tick chart gives each stock an uptick, downtick, or nothing based on the last trade. When a stock trades higher than the previous order, it’s called an uptick. If the stock trades lower than the previous order, it’s called a downtick.

When you go to look up the Tick chart, you’ll generally find it under the symbol TICK. Depending on your platform, this may require a ‘/’ beforehand or a ‘$.’ You will need to discuss with your individual broker to determine the ones they use.

As I mentioned previously, the Tick chart measures upticks vs. downticks. When a stock trades at the same price as the last trade, it gets nothing. That’s why the chart rarely has a lot of extremes.

Now, for obvious reasons, the Tick chart is bound by the total number of stocks on the exchange. Combine that with normal stock flows, and you find that the Tick chart is mean-reverting. That means it always tends to come back to the center from extremes.

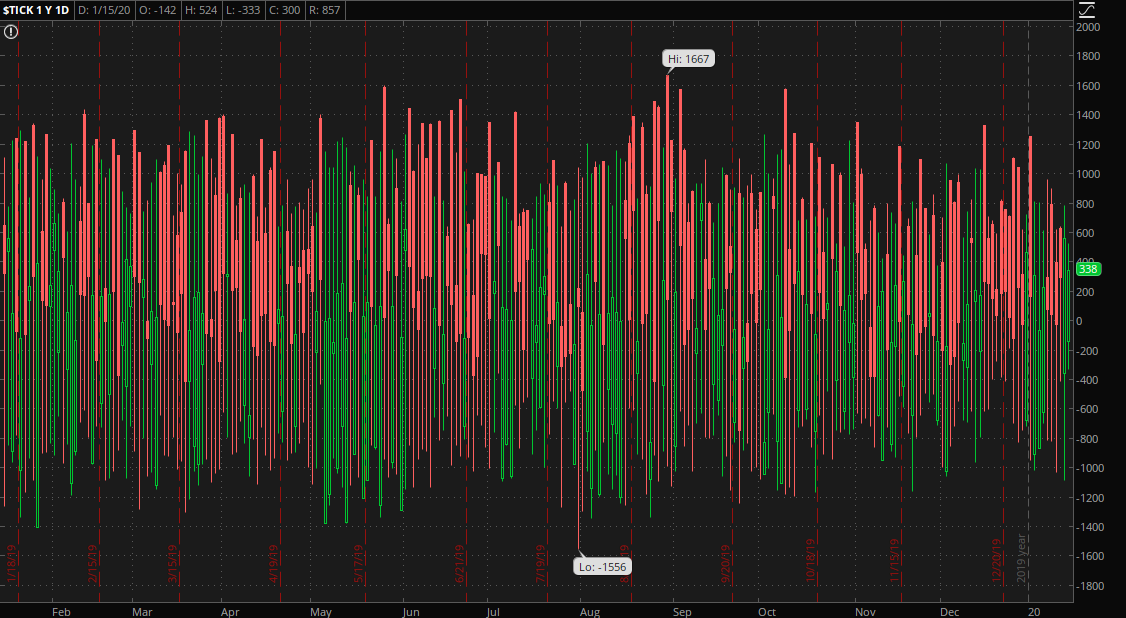

You can see what I mean in the chart below.

TICK Daily Chart

The highest the Tick chart ever got was 1667, and the lowest -1556. If you did an average, it would land somewhere near the middle. That’s why I use the chart to gauge market health on a relative basis.

Important Lines In The Chart

There are a few levels that I want you to take note of +/-600, +/-800, and +/-1000. These create the normal extreme levels for the Tick chart that you want to look at.

Now, here’s the trick to using them – you want to move in the opposite direction of the extremes. So, if the Tick chart hits -800, you want to go long equities. If it hits plus 800, you want to be short.

You’re probably thinking – why would I want to do the opposite?

Well, when you break it down to intraday time frames like the 5-minute through 15-minute charts, you’re looking to trade with the flows. So, when it hits extremes, it tends to move in the other direction. Ideally, you want to see it hit -800, reverse, and head higher. This corresponds typically with a bullish move in equities.

Here’s what it might look like intraday on a 5-minute chart.

TICK vs. SPY 5-Minute Chart

The TICK is the more transparent set of lines on the chart. First, you’ll notice the rectangle outline that shows the SPY candle making a massive dip. At the same time, the Tick chart dipped all the way down to -1,000. That’s a signal that it’s at least reversing for a quick scalp.

Next, you see how the Tick chart started hitting the -1,000 level again as the SPY began to bottom. When the Tick chart rallied, it went all the way back up to +600, which was coincidentally the top in this move.

You can test this out yourself. It’s really fascinating to see how it plays out time and again.

Understand Context

The Tick chart itself won’t make you a better trader. It must be used in conjunction with your typical strategy. All it does is improve your accuracy of entry timing. If you try to use it without your bread-and-butter setup, you’ll quickly drain your account.

Most importantly, you need a strategy that works with intraday trading. The Tick chart won’t do much for you for swing trades. It mainly works for short-term timeframes intraday… generally between 5-15 minutes. Once you go out further, it tells you something entirely different.

It took me several years to discover how to create my TPS strategy and incorporate these measures. You can learn all about it in my upcoming free webinar. I explain how I spent 8 years learning to trade, finally turning my $38,000 account into over $2,000,000 in the last two years.

Source: Weeklymoneymultiplier.com | Original Link