The coronavirus has crippled the global economy and pushed stocks into bear market territory. Of course, world governments are doing the best they can to contain the virus and protect the economy. However, the market is so irrational right now… and many are looking for a flight to safety.

In surprise action, the Federal Reserve cut its benchmark rate by a full percentage point and pledged to buy $700 billion in bonds (good ol’ fashion quantitative easing) to stimulate the economy.

Not only that, but the Fed has made it extremely cheap for banks to borrow money… and they believe it could revive the stock market. However, that action did the exact opposite, as stocks hit limit down, yet again.

Typically, when headlines like those come across the tape — markets should be gapping up. That just goes to show you how broken the market really is at these levels.

If you’re looking for ways to park your cash and generate alpha in this wacky market… you may want to think again with gold, silver, or Treasuries — as they too have been damaged by the coronavirus last week.

— RECOMMENDED —

DOLLAR OPTION TRADER FREE DOWNLOAD

DOLLAR OPTION TRADER FREE DOWNLOAD

HUNT DOWN $1 OPTION CONTRACTS POISED FOR HUGE GAINS.

“INSIDER INFORMATION” REVEALS $1 OPTION CONTRACTS THAT CAN SET YOU UP FOR MONUMENTAL GAINS.

Table of Contents

The “Real” Flight To Safety?

Instead, I’ve discovered a “real” flight to safety that’s directly benefitted my account and performance in this bear market.

It’s A Trader’s Market, And Here’s What’s Working For Me

If you’re struggling in this market environment… don’t beat yourself up and just take a step back to assess what you could do to protect your portfolio and assets. For me, I think the best defense is offense — and that means I’m not looking to pile into the traditional safe havens.

Why?

Well, the traditional safe havens been acting like they are expected to when there’s an ongoing crisis.

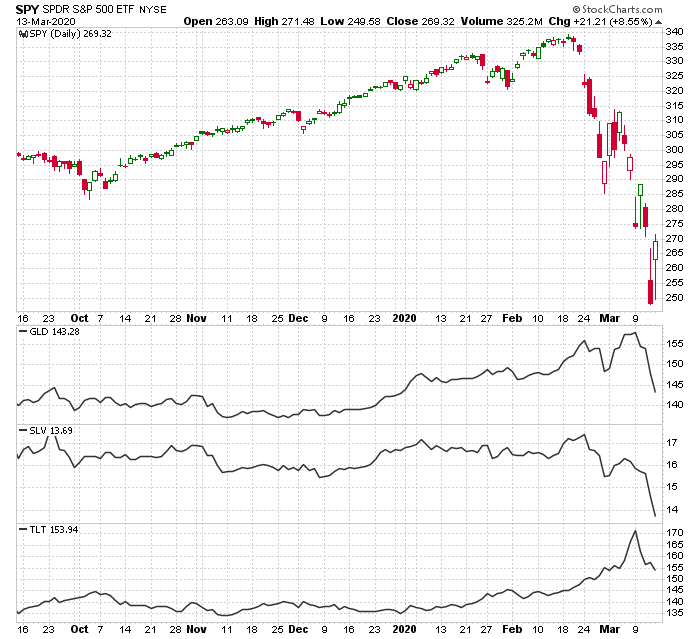

Just take a look at the chart above. You’ve got the SPDR S&P 500 ETF (SPY), followed by the gold-tracking ETF (GLD), then the silver-tracking ETF (SLV), and lastly, the long-term Treasury bond ETF (TLT).

If you look at the traditional safe havens — GLD, SLV, and TLT… they actually sold off amidst the stock selloff. That’s a signal that the market is in a very fragile state.

Instead of searching for safe havens… I’ve been highly selective with my trades and only taking high-probably setups (profit bucks I’ve used to make money before). In times like this, I’ve found trading stocks and options with a clear-cut plan has been extremely profitable…

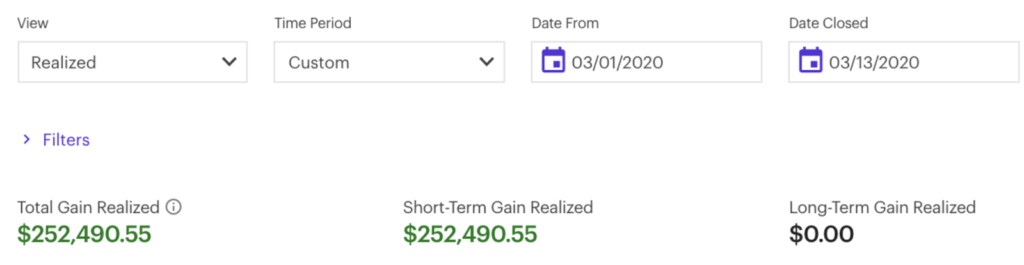

Just 2 trading weeks into March, I was able to rattle off more than $250K in real-money profits.

The Best Defense Is Offense

Let me show you how it works.

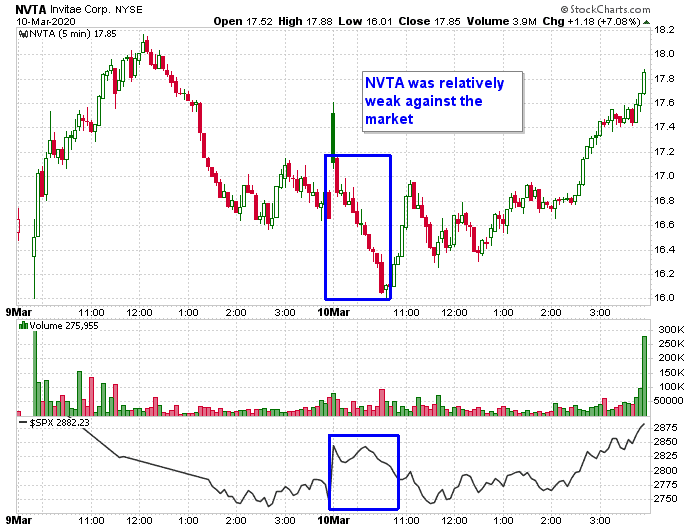

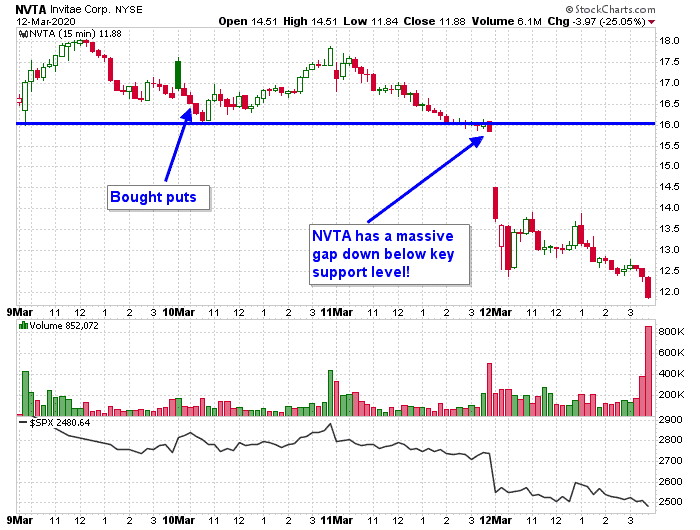

On March 10 at 10:34 AM, I actually pulled up NVTA, and noticed that the stock was relatively weak against the broader market.

Based on that price action, I bought 50 NVTA March 20 $15 Puts at an average price of $0.61. That trade cost me about $3,050 to put on.

Well, guess what happened just 2 days after I entered the trade?

The market was set to gap down significantly! This was great because the only thing that I held in my “portfolio” was one put and cash.

Here’s what NVTA looked like that day…

Of course, shortly after the market open, I decided to take my profits off the table, as those NVTA puts were going for $2.00! That $3,050 bet turned into $10,000, or approximately $6,950 in real-money profits!

In just 2 days, I was able to lock down a 233% winner.

In addition to that profit bucket, I’m also looking for catalyst event plays. In other words, stocks poised to move based on an upcoming event, fundamental change, whatever the case may be. I’ll be revealing my plans for what I think could be the biggest opportunity in decades… click below to tune in.