Your success as a trader is determined by your actions more than anything else.

Why?

Because you CONTROL when you’ll enter a trade. You are in charge of how much is risked per trade. And in turn, your destiny lies in your hands.

Believe it or not, you’ll be surprised at how many traders mess this up by not being flexible enough with their entry points.

Now, I can’t speak for all 7-figure traders, but I can tell you that I prefer to use buy/sell zones vs. a hard number as my entry point.

My buy zone is between the 8-period and 21-period exponential moving averages. When I take on a long position, I want to be a buyer below the 8-period average and above the 21-period average.

This zone identifies the space where I’m getting in between a short-term pullback, but above the longer term trend.

Now, it might sound a little fuzzy at first, but I can assure after some practice it becomes second nature.

It’s precisely how Stacey was able to pull off a +300% win in LSRX.

Every week I show Weekly Money Multiplier members strategies and techniques to improve their trading. If you’re not a paid-up subscriber and would like to join— then click here to get started.

Let’s not have Stacy have all the fun here. I believe you too can benefit from using buy/sell zones as a way to enter your trades. And I’m going to show you exactly how I set my entries up.

Table of Contents

Why these indicators

Some traders use simple moving averages, while others prefer exponential moving averages. It’s generally a matter of preference and how it fits into your trading style.

Simple moving averages weight each price in the specified number of periods the same. For example, a 21-period simple moving average based on closing price would weight all the closing prices for the last 21 periods the same and take an average.

Exponential moving averages are more responsive. They give more weight to recent price action than past price action. I like them for this responsiveness.

My TPS setups work off the premise of a clear trend, a pattern, and a squeeze. As price consolidates in a pattern, the range gets tighter and tighter. The exponential moving averages work better here because they respond faster. With price tightening, I need an indicator that reacts sooner.

Here’s an example of how I used it in a recent Weekly Money Multiplier trade.

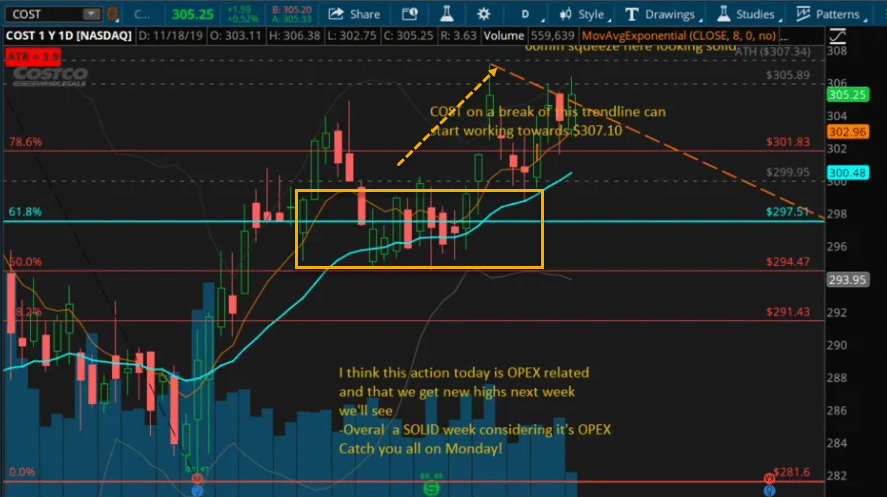

Costco (COST) showed a powerful bullish uptrend over the last few weeks. The stock would make a move up, regroup and then another push higher.

COST daily chart

I highlighted the first area that I found where price consolidated between the two moving averages. You can see how they both began sloping higher, but the 8-period turned sooner.

What’s neat about this area is the zone gives you multiple places to scale into the trade. That’s why I like to take a portion when it first enters the zone, and then another when it gets towards the bottom.

That brings me to how I implement these indicators.

Incorporating EMAs into your trading

Large funds and big money tend to look more at simple moving averages to make their decisions. However, they look at weekly charts, and less at daily charts (certainly not intraday charts). So by no means should you ignore those.

These indicators give me a range to enter a trade. Especially when stocks gap up or down in the morning, this zone gives me a shot to enter the trade with some wiggle room.

It’s important to note that I only use these as places to enter trades. I don’t use them for my stops. I figure those out using other analytical tools.

Before I enter the trade, I want to see the three elements of the TPS: trend, pattern, and squeeze.

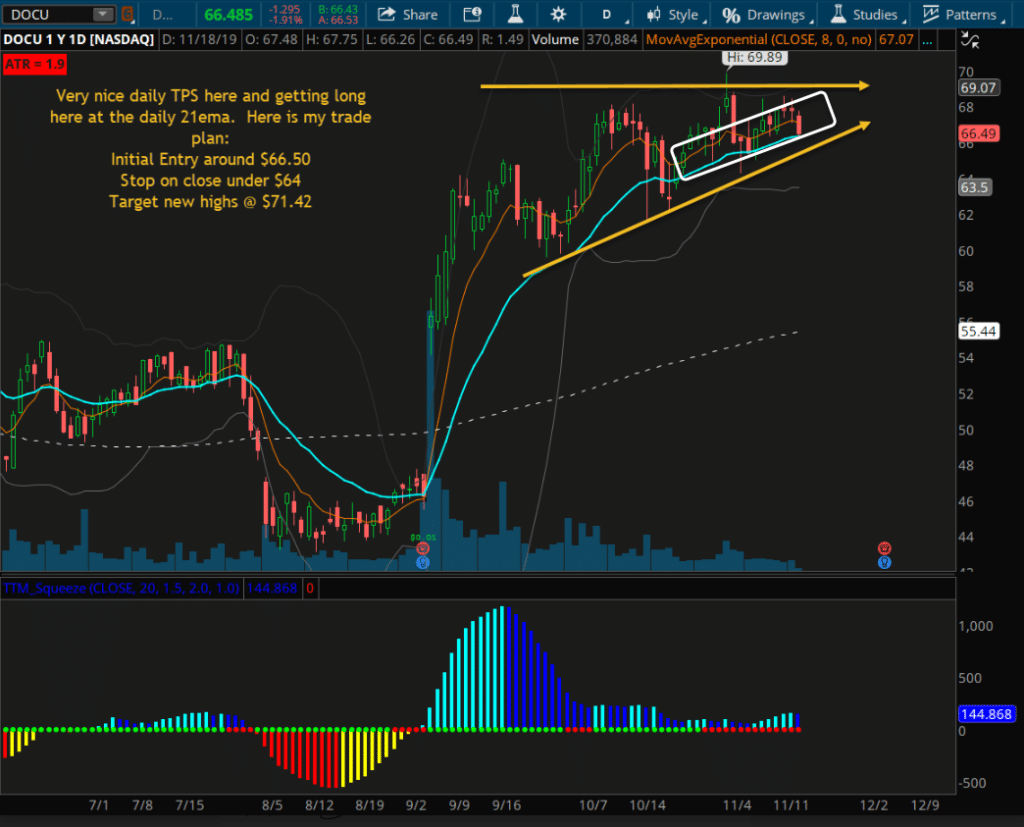

Let’s look at another example from Weekly Money Multiplier – DOCU. Here’s the chart that I sent out to members breaking down the trade.

DOCU daily chart

I waited for the squeeze to take place before I started getting long. Then, I entered the trade at the 21-period exponential moving average. You can also see how I had an opportunity to add down at the 8-period exponential moving average.

Now, you may ask why I would want to add at higher and higher prices. I mean, that’s what the zone sloping upward means right?

As long as all the elements remain intact, then I’m fine adding at the lower end of the channel.

It’s also worth mentioning that my initial stop was a close under $64. As the channel trends higher, if the stock broke out of the pattern on a squeeze lower, I would also consider exiting the trade above that level.

The results for this one speak for themselves:

One key to working these entries is risk management. Every trader should understand how much they are willing to risk relative to their entire portfolio.

Check out my free article Own the 5% Rule, where I discuss some tips and tricks on how to manage your risk.

Click here to read my free article.

If you want to make trades like these your reality then join me at Weekly Money Multiplier.

Click Here to Join Weekly Money Multiplier.

Source: WeeklyMoneyMultiplier.com | Original Link