Last week I went back to my roots, swing trading 3 oversold chart patterns that landed me +20% +$3,000, +1% +$200 and +12% +$3,000 or 3 for 3 +$6,200.

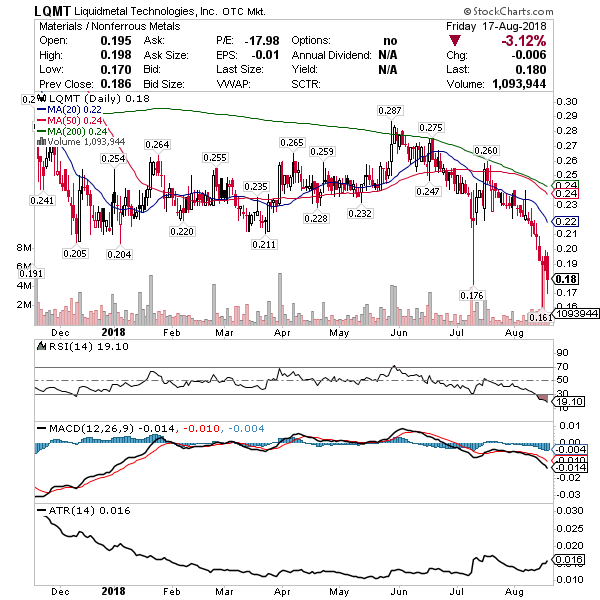

I also took a step toward shutting down my $700,000 ‘baller’ TD Ameritrade account, which for me was a flop compared to trading with a much smaller account, only leaving enough to hold my 1.2M shares of LQMT. Once I score big on LQMT, I’ll be closing the TD Ameritrade account. I’ve funded my same old E*TRADE account with $100,000 and will begin using that this week. My goal is to double it by the end of the year and start 2019 rebalanced with $100,000. Bottom line here is that I tried to scale my strategy going from a $100,000 account to $700,000 account and it didn’t go well for me. Lesson learned, which I will put to video lesson when I have time. Now it’s time to get back on track.

U.S. stock futures continue to climb Monday morning with the major indices SPY, QQQ and IWM nearing all-time highs. I didn’t find any solid looking continuation or breakout plays for Monday so we’ll stick with the oversold patterns for today.

FIT and APRN, from last week’s watch list made nice moves as well. I can’t chase them now but these oversold levels make for excellent long-term entries on pullbacks.

LQMT – Oversold chart pattern, which doesn’t happen often, presents a good long-term entry. My goal here remains in the $.40’s but believe there’s also jackpot potential if they announce the right deal or partnership with a big name company like Tesla or Apple, both of which they have indirect or direct connections already.

—– Related —–

Become a penny stock millionaire with this BRAND NEW EBOOK from famed trader Jason Bond: The Ultimate Penny Stock Playbook.

Become a penny stock millionaire with this BRAND NEW EBOOK from famed trader Jason Bond: The Ultimate Penny Stock Playbook.

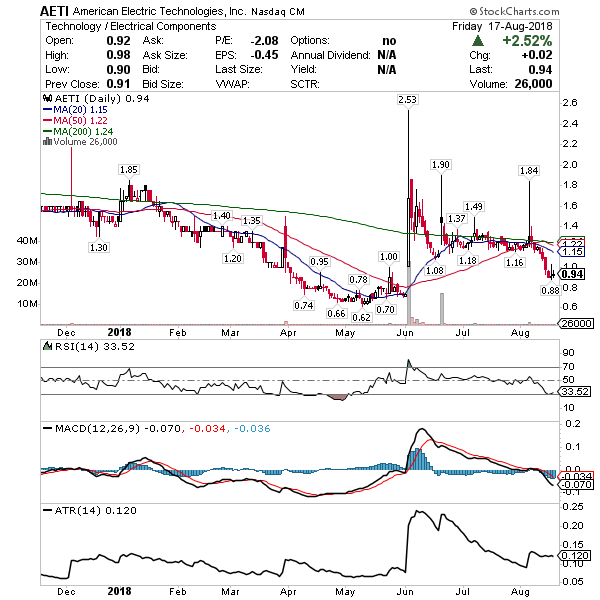

AETI – Oversold chart pattern but not my favorite just yet. However, history of huge spikes has it on my radar if it holds $.90. Range to $1.20 isn’t bad but not as big as I’d like to see. Goal would be 10,000 shares around $.90 for profit at $1.10 or so and $2,000.

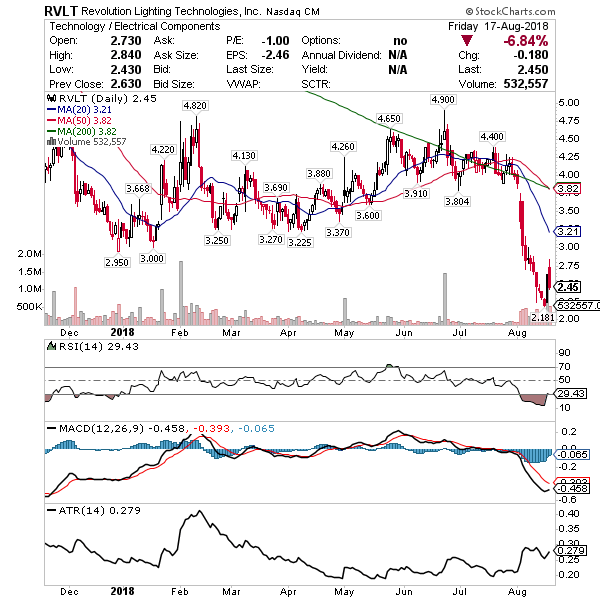

RVLT – After the oversold bounce from about $2.20 to $3 last week, I’m not watching for a higher low setup and continuation above $2.30. Thinking 10,000 shares with a goal of $.30 a share for about $3,000 profit.

MYO – Light volume but see how every time it dips into oversold it squeezes pretty nicely? Last time from about $2 to $3 across 2-days on heavy volume? It’s drifting into oversold again and if it gets a little deeper I may look for 7,000 shares and $.40 a share or $2,800 profit on the way to middle $2’s.

[Ed. Note: Jason Bond runs JasonBondPicks.com and is a swing trader of small-cap stocks. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]