Table of Contents

- 1 Kyle Dennis “Smart Money” Moves – Is GME Set For A Massive Short Squeeze?

- 2 Kyle Dennis “Smart Money” Moves – The “Smart Money’s” Moves In GME

- 3 Kyle Dennis “Smart Money” Moves – Call Buyers Step Into GME

- 4 Kyle Dennis “Smart Money” Moves – Is GME Set For A Massive Short Squeeze?

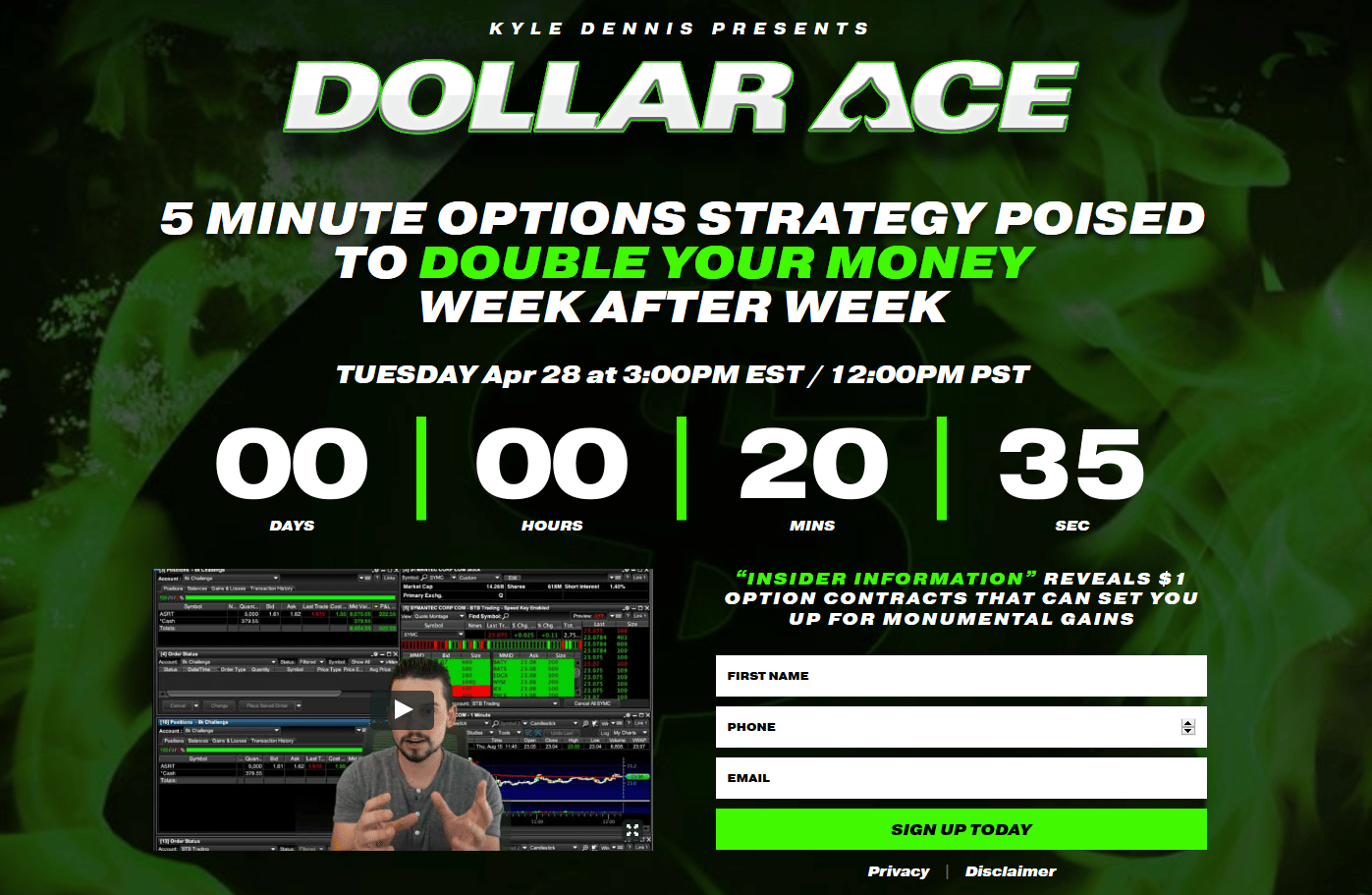

- 5 Kyle Dennis “Smart Money” Moves – Dollar Ace Strategy

Kyle Dennis “Smart Money” Moves – Is GME Set For A Massive Short Squeeze?

The market has been all over the place today, stocks went from green to red — led by tech shares and volatile oil prices. However, when it comes to finding potentially high-probability setups, I don’t necessarily care about what the overall market is doing.

Instead, I like to follow the “smart money” and try to figure out where they’re placing their bets.

Right now, I think the elite traders are looking for a massive runup in GameStop (GME) and I want to show you how I uncovered this trade idea.

When I actually spotted the play in GME, I actually noticed something very interesting about the stock…

It’s got a massive short interest, and the figure is mind-boggling.

So can GME be setting up for a massive short squeeze?

Kyle Dennis “Smart Money” Moves – The “Smart Money’s” Moves In GME

A once-popular video game store, GME sells used and new video games, gaming consoles, and other electronics.

While the gaming sector is on the rise, GME hasn’t been able to adapt as more and more gamers are purchasing video games via digital download.

In late 2013, GME’s shares were trading in the 50s, and with the shift in the landscape of the industry… the stock is now trading around $5 a share.

You’d think GME would be left for dead and get no love from the market, right?

However, GameStop has gotten some recent buzz over the last year.

In late 2019, Michael Burry’s hedge fund bought 3% of GME. In fact, it’s his largest position in the fund, allocating 17.3% in GME.

If you don’t already know, Burry was made famous in the movie the Big Short, his character was played by Christian Bale. He earned $700M for investors on the subprime mortgage collapse — and $100M for himself.

Someone I would definitely call “smart money.” However, Burry’s position is not why I’m writing about GME today — that’s just icing on the cake.

Kyle Dennis “Smart Money” Moves – Call Buyers Step Into GME

The reason is I saw some massive call buyers step into the name on Monday.

On an average day, GME will see about 8,100 call options trade.

However, by 2:30 PM ET on Monday, there were already 27,767 contracts traded. That was more than 3 times the activity GME sees on a typical day.

Mind you, this is when the stock was already up 18.45% on the day (it finished the day higher by 22%).

Here is some of the action I saw that caught my eye:

- 1045 contracts of the May $7.5 calls bought

- 5629 contracts of the July $5 calls traded

Of course, when it comes to these “smart money” trades… I don’t follow blindly and I conduct my due diligence.

Kyle Dennis “Smart Money” Moves – Is GME Set For A Massive Short Squeeze?

Last time I checked the short interest in GME was abnormally high.

To be honest with you, I can’t find the right figure — all I know is that the short interest is at extreme levels. According to Finviz, the short float is 99%…while Morningstar states there are 58.84M shares short, while the float sits at about 56M shares.

What that means is GME one of the most hated stocks on Wall Street.

I know what you’re probably wondering, “Kyle, why does the short interest matter?”

Well, the short interest tells us the majority of shares available to trade have been sold short. Typically, we don’t see the short float near 100% and this is a unique phenomenon.

What I think happened here is that those who owned the shares lent them to short sellers to bet against the stock. Those shares may have been borrowed from one broke and sold to another broker, and the second broker lent those shares to their clients.

In turn, this action caused the short interest to remain at astronomically high levels. This rarely happens, and to me, it’s unprecedented.

When it comes to high short interest, any type of positive news should cause a rip your face off rally.

For example, yesterday, activist firm Hestia Capital Partners, which has a 7.2% stake in GME, announced plans to push the GME’s board to make more changes to increase shareholder value.

That announcement on Monday is why I believe the stock rallied and finished higher by 22%.

Could the options trader be playing an “unknown” catalyst right now?

Only time will tell…

Kyle Dennis “Smart Money” Moves – Dollar Ace Strategy

Now, I haven’t made a move on GME yet, but it’s on my radar… despite the pullback on Tuesday. I’ll continue to stalk my scanner for more options action in the symbol.

You see, when you’re able to decipher what the smart money is doing, you can follow along and profit alongside them.

That’s what my Dollar Ace Strategy is all about.

I believe there are opportunities like this one riddled throughout the market,

All I need to do is know where to look.

If you’re wondering where you can pick up these valuable skills—it’s simple… just check out my Dollar Ace Masterclass and you’ll get an inside look at how I uncover these “smart money” trading opportunities.

[Ed.note: Kyle Dennis runs BiotechBreakouts.com. He is an event-based trader, who prefers low-priced and small-cap biotech stocks.To learn more HUNT DOWN $1 OPTION CONTRACTS POISED FOR HUGE GAINS and download his FREE “DOLLAR OPTION TRADER” Playbook here!

Source: Biotechbreakouts.com | Original Link