It’s been a tough market out there. Stocks had their worst one-week selloff since the global financial crisis, and market participants are taking it on the chin.

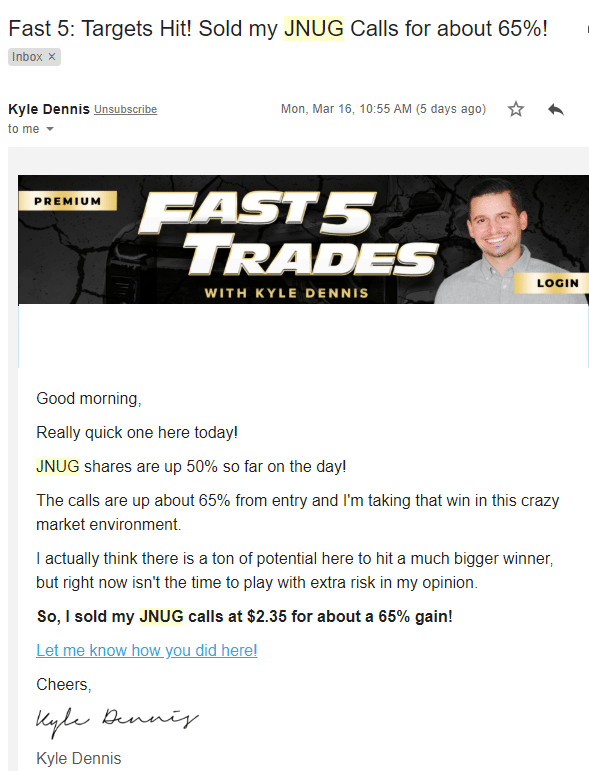

If you’ve been beaten down by the market, don’t fret… because I want to show you there are ways to make money in this environment. In order to put you in a position to succeed, I want to bring to your attention one of my best profit buckets — Fast 5 Trades.

So what’s Fast 5 trades?

It’s my answer to how to find winners in this market environment… like my 65% gain in JNUG calls on Monday.

This market environment is so different from what it was just a few months ago, and buying the dip hasn’t been working out for many market participants. Instead of randomly jumping into stocks just because they’re moving…

Today, I want to walk you through my latest Fast 5 Trades winner in JNUG, and prove to you that sometimes, all you need is just one trade idea a week.

Table of Contents

[Exposed] How I Uncovered A 65% Winner In JNUG

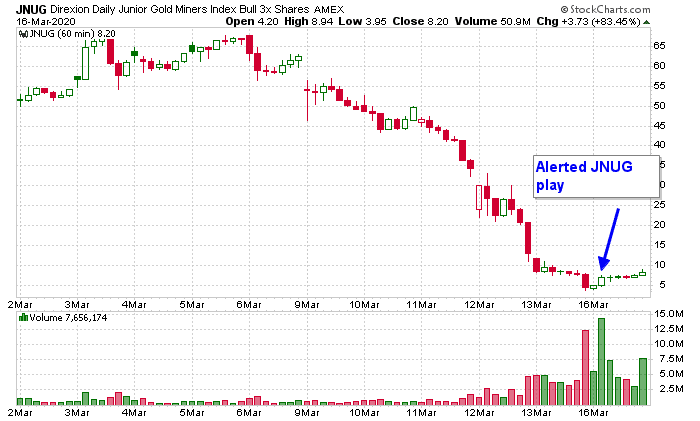

On Monday, stocks got smoked, as the S&P 500 suffered one of its worst single-day drops in history. With the market down about 10%, I knew I had to be locked and loaded to find my best idea for the week. The goal is to get in on Monday and lock in double-digit (or better) returns before Friday.

As I scoured through hundreds of stocks, exchange-traded funds (ETFs), and exchange-traded notes (ETNs), I found one trade idea that made the most sense: Direxion Daily Junior Gold Mine (JNUG). Why?

Well, the Fed cut its benchmark interest rate to a range between 0% to 0.25%. In a low interest-rate environment, gold-related plays have a high-probability of going up. You see, this makes gold stocks more attractive because other safe havens (bonds) won’t yield as much.

In turn, one would expect the demand to pour into gold stocks.

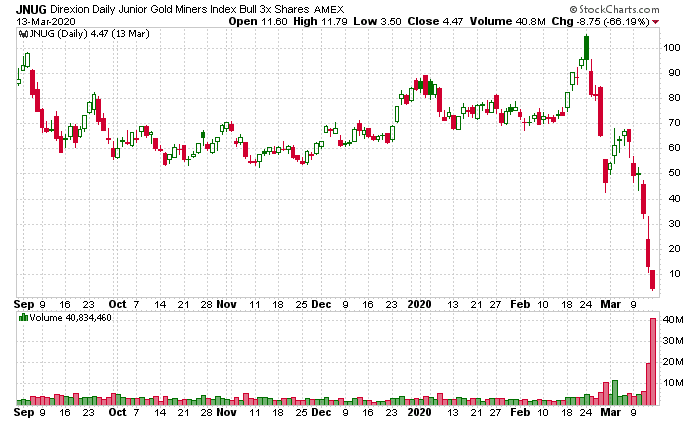

The thing is… no stocks were safe amidst the bloodbath. JNUG got destroyed and lost more than 90% of its value in just a few weeks. Now, the one thing to note about JNUG is the fact it’s a 3X leveraged ETN. In other words, it’s a risky play.

The ETN aims to track 300% of the performance of the MVIS Global Junior Gold Miners Index, which provides exposure to micro- and small-cap gold and silver mining companies.

Well, if you think about it… when the market is selling off and a low interest rate in place, this was a high-probability setup in my eyes, although risky. Rather than buying JNUG outright, I wanted to properly risk manage the trade.

The Play

So what did I decide to do?

I purchased the calls. That way, I maximize my upside potential, while reducing my downside risk (it’s known right off the bat, and the most I could lose was the premium paid).

Once I found the play and had a thesis… I let Fast 5 clients know about my moves.

I purchased 50 JNUG March 20 $6 calls for $1.44. There were just 4 days left until the expiration date, and that specific trade was perfect for Fast 5 Trades.

Here’s what happened with the trade…

JNUG got a nice pop… and in under an hour, those calls EXPLODED!

I was able to lock in a 65% return on those calls, and my target was hit!

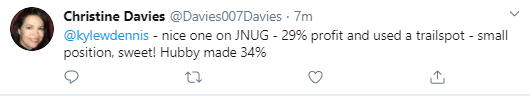

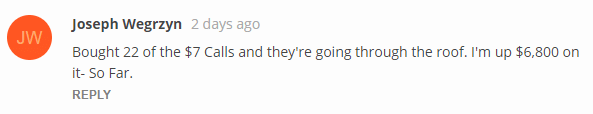

However, I wasn’t the only one who banked on this setup…

With Fast 5 Trades, you don’t have to worry about what the overall market is doing.

That’s the beauty of this trading strategy, all you have to do is focus on the one trade you’re in.

After it’s closed out, you can just go about your week. Let Fast 5 Trades be your edge in the market, and sign up here.

[Ed.note: Kyle Dennis runs BiotechBreakouts.com. He is an event-based trader, who prefers low-priced and small-cap biotech stocks.To learn more HUNT DOWN $1 OPTION CONTRACTS POISED FOR HUGE GAINS and download his FREE “DOLLAR OPTION TRADER” Playbook here!

Source: Biotechbreakouts.com | Original Link