I love real estate investment trusts for one reason.

They make gobs of money.

Now for those who don’t know…

Real Estate Investment Trusts (or REITs) are publicly traded companies that own commercial real estate and generate massive amounts of cash flow from tenants.

And they’ve crushed the market for decades.

Equity REITs were the top-performing asset class in the stock market dating from 1972 to year-end 2019.

NAREIT reports that equity REITs have returned 11.82% a year since the days of the Nixon administration.

Meanwhile, the S&P 500 has averaged 7.35% a year.

That’s nearly 50 years of outperformance.

It feels like a secret, doesn’t it?

Well, there’s a reason for that. Real estate doesn’t get a lot of attention because – let’s be honest – there’s nothing sexy about office space, storage buildings, or industrial centers.

But when you follow the money, you learn fast that this is where long-term investors build wealth.

NAREIT estimates that the value of the commercial real estate industry in 2018 sat between $14 TRILLION and $17 TRILLION.

And all of this property generates incredible amounts of money for investors from rents, tax benefits, and price appreciation.

But there’s one other benefit to REITs.

They can tell us what the markets think will thrive and what will survive in the COVID-19 crisis.

Check this out.

Ignore Earnings Season

“What companies will survive?”

That’s the question swirling across trading floors, media channels, and even Zoom cocktail parties.

The COVID-19 outbreak in the U.S. has peaked right at the start of the earnings season.

Over the next few weeks, we’re going to see some wild swings in stock prices. Companies will release earnings, offer mixed outlooks, and likely eliminate any forward guidance on financial expectations for 2020.

We’ll see dividends slashed. “At-home” stocks like Netflix (NASDAQ: NFLX) will likely rally.

But many GREAT retail and hospitality companies – which thrived before this outbreak – now face potential bankruptcies and defaults.

So, who does the market think will thrive during and after the coronavirus outbreak?

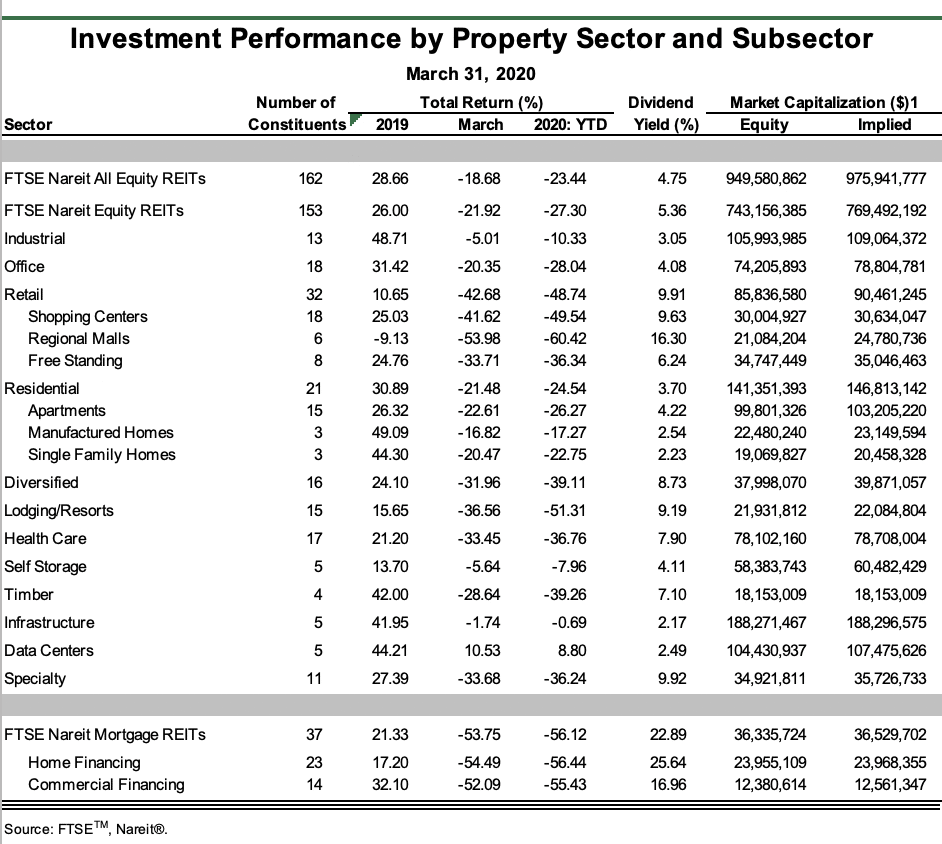

The answer is found inside this chart.

This chart highlights the performance of Real Estate Investment Trusts in March and since the beginning of 2020.

Now just to remind you, REITs own a variety of different types of properties that offer steady cash flow and provide steep appreciation upside. REITs also offer incredible tax benefits including pass-through income and the ability to deduct depreciation (you can write off about 3.6% of your property value every year against any income you’ve generated from property).

Now, some REITs own properties like warehouses or timberland.

And some own apartment buildings or office space.

Others like Tanger Factory Outlets (NYSE: SKT) own shopping centers, which are suffering due to social distancing guidelines and the shut down of the economy.

There are many different categories, and all of them offer a glimpse into real-time expectations for the economy, various industries, and their tenants.

Rising rent prices and occupancy rates suggest an expansion of a sector and expected success for companies in those industries.

Falling occupancy rates, rising delinquent rent payments, or lower rent prices suggest lower demand for products and services in a specific industry.

I track REITs to get a better sense of how big financial institutions – which own the lion’s share of these publicly traded stocks – feel about specific industries moving forward.

It also tells us who is surviving or even thriving.

For example, data centers – the companies that own storage facilities for technology companies, servers, and call centers – they were up more than 10% in March.

This makes sense.

The economy has shifted dramatically from large office space to work-from-home setups.

And more people have embraced e-commerce, a data intensive industry.

It’s honestly that simple. When you count companies like Amazon, Microsoft, and Google as customers, you have a sector that isn’t going to run out of demand.

That 10% gain for Data Center REITs indicates that Wall Street believes a lot of technology companies are safe right now.

Meanwhile, lodging REITs – which own hotels and conference centers – plunged. Retail REITs – particularly ones that own shopping malls – are trading at levels that suggest massive bankruptcies for their clients.

So, we will likely avoid hospitality companies and retailers until we start to see optimism about the real estate companies that count them as tenants.

Other sub-sectors that have held up well include industrial REITs – which are expected to see extraordinary demand as companies move their manufacturing back to the United States.

Also, we’ve seen higher demand from cannabis growers that use warehouses for cultivation to meet rising demand.

The market thinks a lot of deep-pocketed pharmaceutical stocks and supply chain companies are going to meet their rent agreements and rebound in the future.

Infrastructure REITs – which include cell towers – were also off just 1.7% in March. Shares have risen this month – as companies expect continued demand from their customers that include AT&T Corporation (NYSE: T) and Verizon Communications (NYSE: VZ).

Also, these REITs will see an explosion in demand from the widespread adoption of 5G technology.

Yet when I look at this chart – something really surprising stands out. I think that these big investors are overreacting with a 33% drop in March for one sector.

And that has created a unique long-term opportunity that might never return again.

Make Medical Real Estate a Long-Term Holding

While the REIT chart tells us a lot about equity REITs, it does reveal a somewhat surprising disconnect in a few different industries. I see some bottom-feeding opportunities right now.

Medical REITs – the firms that own hospitals – are still off sharply from their February highs.

Given that we are facing a health crisis, how exactly are hospitals going out of business or lacking the money they will need to pay rent? After all, the U.S. government has pledged unlimited funding to the hospital industry.

For example, Medical Properties Trust (NYSE: MPW), for example – owns acute care hospitals.

These are the same hospitals that are being overrun with patients. These hospitals are going to pay their rent and aren’t going out of business. Yet it’s trading about 29% lower than its 52-week high and pays a dividend of 6.2%. The dividend has effectively been guaranteed by the U.S. government over the next year thanks to funding efforts to keep hospitals running.

I’m going to dive into this opportunity tomorrow.

But more importantly, I’m going to show you how to make even more than 6.2% on that dividend and generate real money from a mispriced opportunity in the market.

If you’d like to learn more about my investment strategies then make sure you’re signed up for the Strategic Investors Summit. You’ll receive my brand new eBook, the 10X Portfolio Blueprint, hear interviews from industry experts. As well as, the main event when I go live April 21st at 8 PM ET.

You don’t want to miss this – Click Here To Register.

Learn more about Jeff Bishop’s Strategic Investor Summit Here