Going through ups and downs in the market is all part of the game…

… but it’s how you adapt when you’re down in the dumps that can either turn you into an elite trader… or just another statistic.

The thing that sets the successful traders from the ones who don’t make it is the mindset.

When the going gets tough… the top traders won’t make excuses… instead, they look back and analyze their performance and look at what’s working for them and what’s not.

That’s how you turn your weaknesses into strengths and thrive in the markets.

With the third quarter coming to a close… I analyzed my trading performance thus far and tried to see whether there were any holes in my game.

So far, I’ve made more than $530K this year… trading part-time, despite taking a full 2 months off from trading. That’s a personal best for me, and I really don’t think that’s a coincidence.

Along the way, I came up with three tips I think can help your trading today…

Table of Contents

Actionable Trading Tips to Boost Your Performance

Tip #1: Despite what the headlines say, stay the course and have a plan.

Tip #2: Trust your bread-and-butter strategies

Tip #3: Never stop assessing your performance and adding new strategies.

Tip 1: Staying in the market

Thinking back to the fourth quarter last year… it was an absolute mess.

Markets tanked for 3 straight months scaring a lot of traders out of the market… and it seems like traders are getting paranoid that it could happen again this year.

How am I going to prepare for a potential market correction?

Well, I’m going to do exactly what I do when the market has violent swings… keep trading.

In the fourth quarter of 2018, I kept trading through it all and as a result, caught the huge bounce in the first quarter of 2019… a bounce many missed having moved to the sidelines.

Talk about a whipsaw.

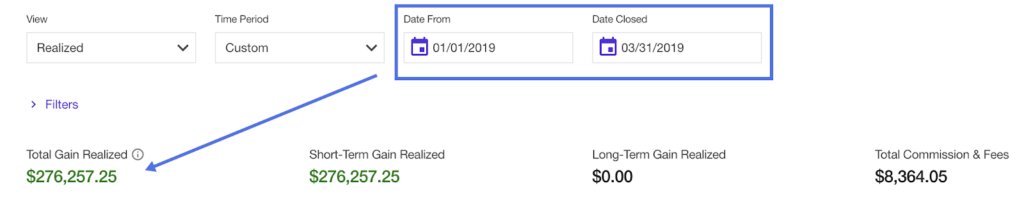

Over $270,000 in profit for me in the opening months of this year. Now you can see why I took 2-months off trading just after that.

Whatever the market pundits are saying to strike fear in you, causing you to avoid trading the markets… ignore the noise and stay the course.

All you have to do is focus on price action and a few simple patterns.

Tip 2: Trusting my strategy

During 1Q 2019, I took a huge loss of -$23,304 loss on the rocket BPTH having mistimed the Fibonacci retracement by just a bit.

I remember thinking how horrible I felt getting that one wrong and when the moment came to sell I was able to take solace knowing my mistake was an outlier…

I had to take my licks and sell for a loss because I knew, for certain, the pattern I was playing had broke and whether I liked it or not, it was time to move on.

See, holding onto a loser after I know the pattern is broken — the pattern I was using in the first place — is the cardinal sin in this game and the gateway to bag holding.

I mistimed my entry, the loss escalated fast as you’d expect with a chart like this…

… and instead of letting the pain eat at me day after day, I knew the right thing to do was eat the loss and move on.

My strategy is strong, but sometimes outliers will happen… I don’t have to like it, but if my rules say move on, then it’s time to move on.

I was up over $200,000 in 2019 at that time… and now I’m up more than $500,000. The bottom line is I have confidence in my patterns, so in times of outlier events, I can execute the loss knowing fully well my strategy isn’t just one trade, but a myriad of trades over weeks, months and years.

Tip 3: Assessing performance and adding new strategies.

Since I was walking down memory lane…

I thought back to what was going on with my trading 3 years ago.

In 2016 — having done well with small caps for nearly 5 years in a row — I got bored and started buying calls and puts, often on the IWM small cap index but other big-name stocks too.

From 2016 – 2018 I’d crush it with small caps — just guessing here but let’s say $500,000+ per year on small-cap stock profits and $200,000+ per year on options trading losses.

Again, those are just rough numbers to illustrate the trend.

Now because it was usually all out of the same account… at the end of the year I’d have a profit of $200,000-$300,000 and happy with my performance.

Until 2018… that is when it all unraveled.

Last year, my option losses started to engulf my stock gains and I had no choice but to really examine everything.

Honestly, it didn’t even strike me at first that it could be buying options that was hurting me…

Don’t Forget to Journal Your Trades

I was just flat out frustrated with my trading and needed to step back.

See in 2015, having had so much success over the years, I’d pretty much stopped journaling, something I’d been super strict about year after year when I was really learning to trade.

Point being, I didn’t really have a good idea where my weaknesses and strengths were in my trading anymore.

So one of the things I did was have my accountants analyze my performance separating stock trading from options trading.

BOOM!

There it was, I was crushing it BUYING stocks and getting crushed BUYING options.

The data was so compelling I didn’t see how I could BUY another option again.

Months passed and I got to thinking, I’m a pretty damn good trader and BUYING options crushed me.

So if I was BUYING options, someone was SELLING options to me and taking my money.

After hours of research and tweaking my simple options trading system… Weekly Windfalls was born and my second trading strategy with it.

Now I make good money on momentum small caps using my patterns… but I make even better money (so far it’s pacing that way) SELLING options to guys and gals who love buying options, but are not trained to do so.

[Ed. Note: Jason Bond runs

JasonBondPicks.com and is a swing trader of small-cap stocks. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]

Source: JasonBondPicks.com | Original Link