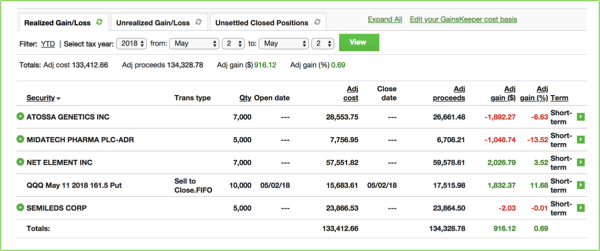

+$916.12 profit Wednesday & +$13,653.52 in May and +$171,917.96 in the last 5 weeks.

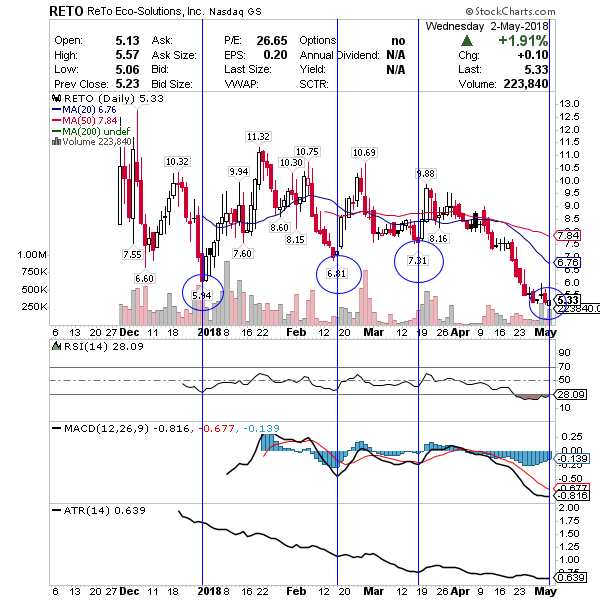

RETO is my only swing trade headed into Thursday and I really like this one. Fundamentally strong company, having recently IPO’d at $5. Bounces huge after pullbacks as noted on the chart below. Goal is profit between $7 – $8 or a few points per share.

Long-term APRN had good earnings this morning and is up +10%. My goal is closer to $3 so we’ll see if it gets there before the weekend for profit. I maintain this is a likely takeover candidate which should lead to a double if that news hits. Provided it doesn’t hit my profit goal of $3ish before the weekend I’ll issue a full report on it soon.

—– Related —–

Become a penny stock millionaire with this BRAND NEW EBOOK from famed trader Jason Bond: The Ultimate Penny Stock Playbook.

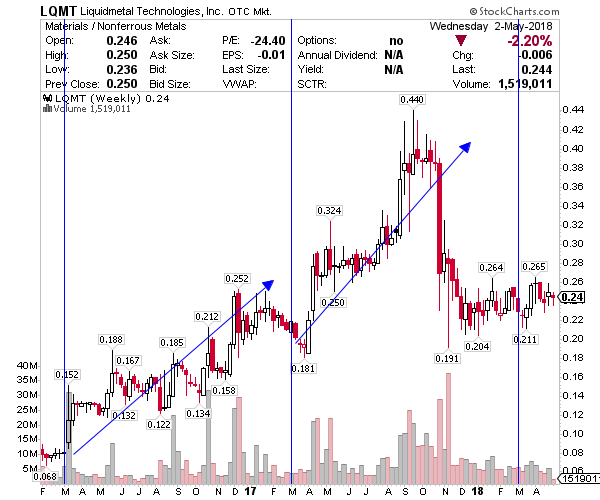

Long-term LQMT should start it’s annual uptrend into Apple’s iPhone 11 launch in the fall in September. Here’s a 3-year weekly chart illustrating how the stock more than doubles from March to September every year into this event. The vertical line around $.07 in 2016 marks the start of the runup and by September the stock hit $.19, the vertical line around $.18 in 2017 marks the start of the runup and by September the stock was above $.40. If this pattern holds true, a move above $.40 is likely by the fall as big news outlets like this one start to speculate what the iPhone 11 will be made of and you can bet Liquidmetal will make big speculative headlines into that, as it’s done over and over for years.

No updates on long-term ROX, I still maintain a takeover is the likely exit here.

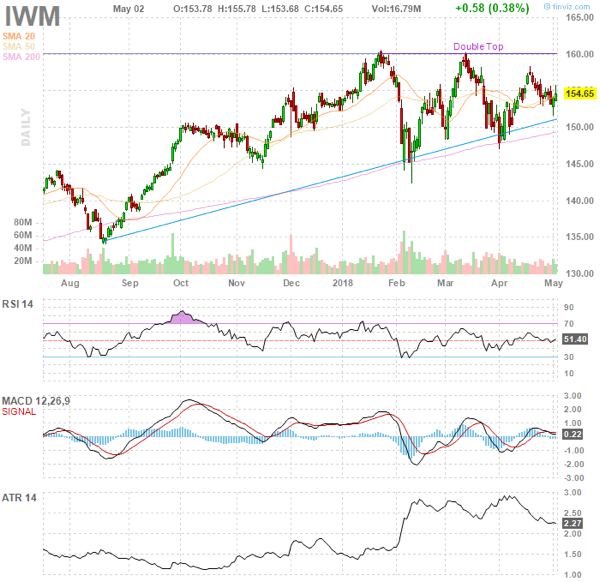

U.S. stock futures are flat Thursday morning after the FOMC announcement Wednesdaysaid there wouldn’t be a rate hike. The small cap index seen below was the strongest mover of all the major indices Wednesday which could be a sign the markets will climbThursday. This ascending triangle seen below is a powerful and reliable continuation pattern which should close soon with a breakout above $160. I’m bullish overall until the pattern shows me to stand down, so expect to hear from me a lot this afternoon, after I return my iMac Pro to Apple.

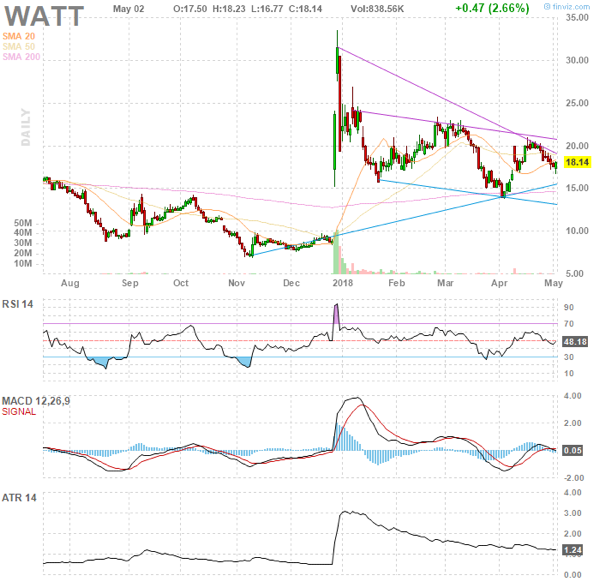

WATT – I hit the oversold bounce for 40% at the beginning of April and now I’m watching the continuation pattern above $18. Their wireless charting technology approved by the FCC is a game changer and this stock could eventually double from these levels on the right news, like a deal with Apple etc… it’s stocks like this that I love taking swings on as sometimes I catch the big news overnight.

NETE – As bitcoin continues to consolidate in the $9,000 range NETE consolidates in the $8’s. I like this above $8 for a move to $10 and do believe bitcoin runs here soon to $12,000 and I’d like to be in NETE on / off ahead of that pop. If NETE gets above $10 there’s big range to $15 and with the recent addition of Najarian to the board I think big news is coming here.

[Ed. Note: Jason Bond runs JasonBondPicks.com and is a swing trader of small-cap stocks. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]