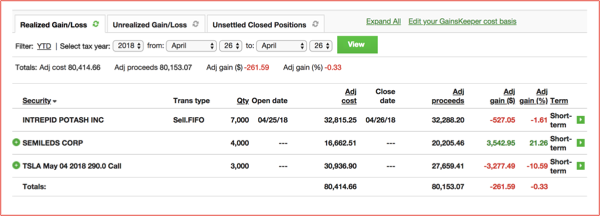

I took a small -$261.59 loss Thursday, mostly on some TSLA calls I traded in the Millionaire Roadmap.

Bitcoin is popping Friday morning so the usual suspects DPW, RIOT, NETE, TEUM and MARA are on watch. Here’s a full list of the bitcoin small caps I watch when bitcoin is making moves.

Looks like we could have a big day in the market Friday after AMZN crushed earnings and first quarter US GDP, which just came out a few minutes ago, blew past estimates. I felt like it might be a strong market Friday which is why I carried 5 swing trades overnight. Let’s break these 5 stocks down real quick.

—– Related —–

Become a penny stock millionaire with this BRAND NEW EBOOK from famed trader Jason Bond: The Ultimate Penny Stock Playbook.

DXR and HTGM are rounding patterns that look very similar to the J Hook or oversold chart pattern, however neither RSI is below the 30 line, making it more of an oversold setup inside a longer term continuation pattern. I love taking shots at stocks like this because they’re often packed with shorts who tend to cover into weekends to avoidMonday press releases. Both have a recent history of consistent huge spikes too.

LEDS was the same pattern as DXR a few days ago, until it shot up like a bottle rocket from about $3 to $5. I’ve been playing this one a lot and made nearly $12,000 on it recently. Now Wednesday and Thursday it’s made big moves at the open, so Fridayshould be the same. I’ll do exactly what I did Thursday, adding size near the open if I think it’ll pop and looking for my typical 5-20% on the way up.

LLNW and VTVT are Fibonacci retracement continuation patterns from my lessons. Shares of LLNW broke above the recent high Thursday suggest a move to the middle $5’s, or if really lucky, $6ish, could happen today. VTVT has huge range if it wants to run again Friday, I’d say to $3ish if it really gets going, I may add 10,000 to this one today looking for a middle $2’s move.

No updates on long-term ROX, still thinking buyout after the Patron takeover. I will keep you posted if something material comes up.

APRN – Shares moved higher Thursday, ahead of earnings next week when Mr. Wonderful, Kevin O’Leary picked it on CNBC as a takeover target. I believe he’s right and might take 10,000 shares long-term today, which means I’ll hold through next week’s earnings.

“Having gotten close to that industry, getting involved with Plated, which was acquired by Albertsons … I thought, I know this space,” O’Leary said after the draft. “Blue Apron can’t survive on its own and it’ll get acquired, and I’m thinking the acquisition price could be between $4 and $5.” ~ Kevin O’Leary

HEAR – Been trying this one on and off all week and might take another stab at it today above $5 with a tight stop loss. This is a momentum stock and not for beginners. I’d say it’s in play above $4.80 looking for a breakout above the recent high of $5.75, which would trigger a squeeze. Goes up and down fast, so take those profits when you have them.

Finally HMNY showed signs of spiking Thursday, no doubt a result of it being heavily shorted. I’m not a huge fan of the stock right now but will say, if it were to make a 10-20% run, today is likely to be that day given shorts might bid it up before the weekend. In play above $2.40, looking for $.20 – $.30 / share on the way to the upper $2’s.

[Ed. Note: Jason Bond runs JasonBondPicks.com and is a swing trader of small-cap stocks. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]