If you’ve got questions about which timeframes to trade, you’re not alone. That was one of the most common responses on last week trader’s survey.

Is there a ‘best’ time frame, though?

It really depends on your goals. And to some extent, on your account size. That said, many traders like to use multiple timeframes.They use moving averages on a higher timeframe to identify the trend.

Then they’ll drop down to a lower timeframe to take setups.

For example, you could follow a weekly trend for daily swing trades. Or you could use a 60-minute trend for day trades on 5-minute chart.

So far, so good…

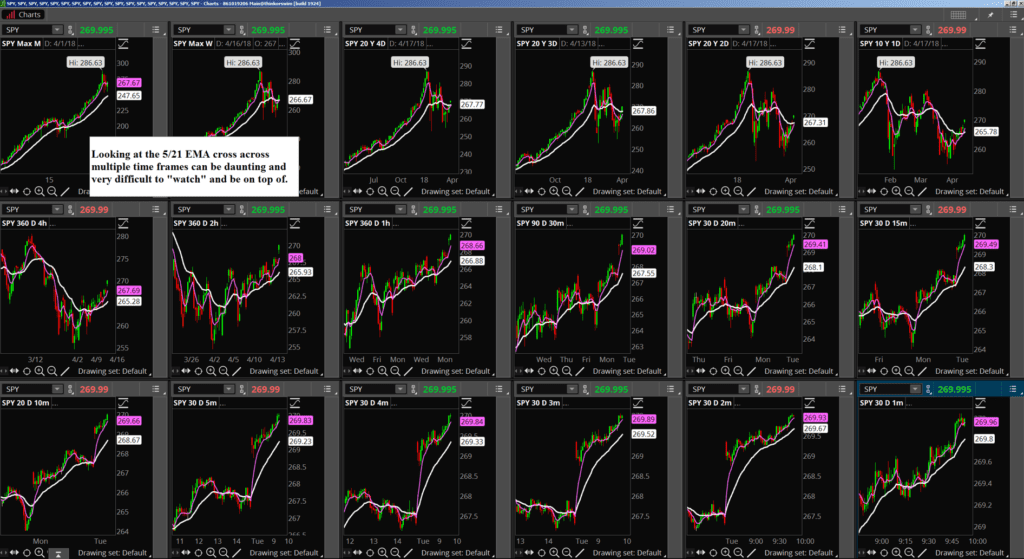

But before long you’ll notice each chart tells a different story. Like this…

There might be a downtrend on the weekly chart, an uptrend on the daily, and a downtrend on the 60-minute chart.

What do you do then?

You could look at MORE timeframes to try to get clarity, right?

It’s clear the idea of multiple timeframes can offer a powerful perspective. But it’s also possible to get lost in analysis paralysis, too. That’s when you can’t decide what to do because you have too much information.

Reason I bring this up is because I’ve wrestled with this same challenge. I’ve experimented with just about any combination you can imagine. And I’ve found different combinations that work pretty well together.

But recently I had the opportunity to talk with fellow traders at our Austin Mentorship. After hearing the same feedback from many different people, I had an epiphany.That led to several months of development and experimentation.

I’m glad to say I’m finally ready to show you what we’ve discovered.

It’s a simplified way to look at multiple timeframes…

If you’re even a little bit curious about multiple timeframes, I think you’re going to love this.

You won’t have to wonder which is the ‘best’ timeframe.

You won’t have to doubt your entries or exits, either.

There’s even a way to tell, in advance, how BIG of a move to expect.

And it’s all possible thanks to this ONE epiphany I had at the Mentorship.

If you want to check this out, join me for the Dynamic Profit Target webinar on May 23rd.

I’ll walk you through exactly what’s possible now.

This discovery directly complements just about any trading strategy (especially if you use any of our tools).

If you’re looking for more objective entries and exits, this webinar is a ‘must see’.

And I’ve only mentioned a FRACTION of what we’ve been working on.

You’re going to be blown away.

Go ahead and reserve your spot…